Survey Sheds Light on Developing a Private Debt Market in Aotearoa New Zealand

Private debt markets are a relatively untapped investment option in Aotearoa New Zealand despite significant growth overseas, a new report reveals. Private debt is a way for companies to borrow, but rather than obtaining the funds from banks, they receive the money from institutional investors.

The report, drawing on a survey of institutional investors, is a collaboration between the Climate and Energy Finance Group (CEFGroup) at the University of Otago, Griffith University, MyFiduciary, and Private Capital Group.

The survey focuses on the potential and challenges of the private debt market in New Zealand, seeking to understand stakeholders’ views on private debt and how this can help the country transition toward sustainability.

The private debt market is still largely underutilised in New Zealand, with many investors yet to make their first commitment to this asset class.

The survey highlights several challenges for investors, such as a lack of experience, liquidity risks, and a relatively small market size. This may be attributed to limited knowledge of its benefits and misconceptions about its complexity and risk.

Dr Renzhu Zhang, the lead author, of the University of Otago, says overseas investors view private debt as a means to obtain higher returns, while this is not a major focus for investors in New Zealand.

“It’s almost like they don’t see the potential for really doing well out of it,” Dr Zhang says.

Private Capital Group Founder and CEO Paul Carman says domestic investors are not fully aware of the differences between public and private markets due to the latter’s novelty in New Zealand.

Mr Carman says the regulatory pressures on bank capital have driven the growth and development of private debt markets offshore, and are now doing so in New Zealand.

MyFiduciary Principal Greg Peacock is positive about the development of the market in New Zealand, saying private debt has grown to have a significant share of the lending market overseas and has provided robust returns to investors.

“The same pattern is just beginning in New Zealand,” Mr Peacock says.

These sentiments are supported by the survey’s findings, which indicate both private and non-private debt investors are optimistic about the future of the asset class.

The survey results indicate that the positive outlook among private debt investors suggests the asset class has been rewarding for those who have invested in it.

The survey also shows strong support for the development of a private debt market in the country, with investors viewing it as a critical tool in achieving their environmental, social and governance (ESG) and impact goals.

Professor Ivan Diaz-Rainey, of Griffith University, says a big advantage that private debt investors have, is that they can ask companies tough questions directly about their sustainability and then measure their ongoing performance.

“Our survey results indicate that investors see it as a great way to have an impact on sustainability. Because it’s a much more direct investment between the investor and the investee company.”

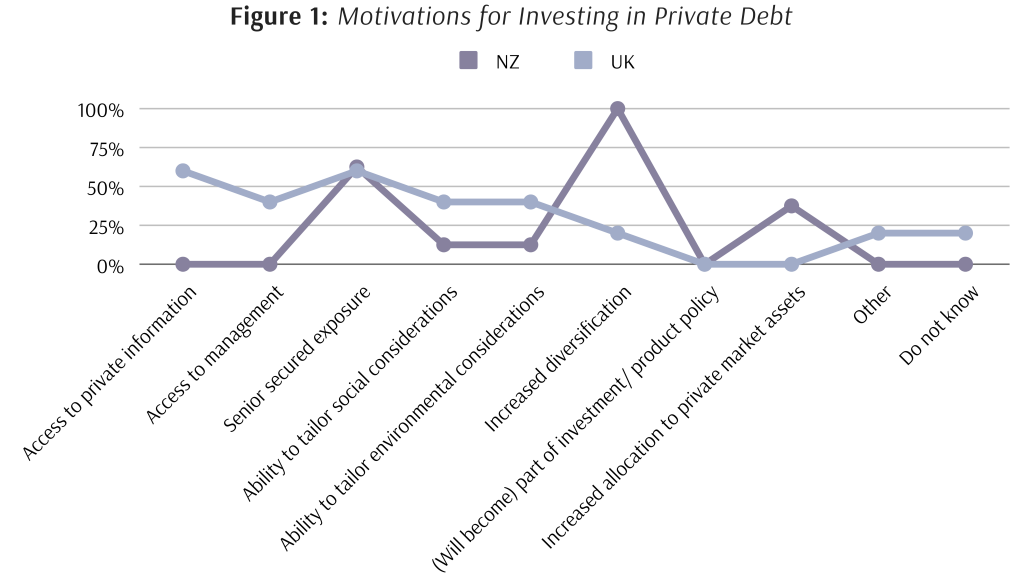

The survey finds notable differences between investors in New Zealand and the UK regarding their motivations for investing in private debt (see Figure 1, above).

UK investors place greater emphasis on access to private information and management, as well as the ability to customise their investments with social and environmental considerations.

On the other hand, New Zealand investors are attracted to private debt as a means of diversifying their investments and spreading risks.

Further, the two groups have different preferences when it comes to what they hope to gain from investing in private debt.

New Zealand investors tend to prioritise safety and are more conservative, preferring to invest in asset-rich companies, while investors in the UK are more willing to lend to riskier sectors.

Professor Diaz-Rainey suggests that to achieve the country’s economic goals, New Zealand investors will need to broaden their perspective and be open to investing in private debt in businesses that are not just asset-rich.

He emphasises the potential for the private debt market to be a significant driver of growth and sustainability for New Zealand.

“It’s a huge opportunity for the country. Along with private equity and traditional bank lending, it could play an import role in funding the next generation of Kiwi companies.”

A copy of the industry report can be found here: A Private Debt Market for a Sustainable Aotearoa NZ

For further information, please contact:

|

Paul Carman [NZ] Founder and CEO, Private Capital Group Email: paul@privatecapitalgroup.co.nz Phone: +64 273400929 |

Ivan Diaz-Rainey [AUS] Professor of Finance, Griffith University Email: i.diaz-rainey@griffith.edu.au Phone: +61 426910630 |

|

Greg Peacock [NZ] Principal, MyFiduciary Email: greg@myfiduciary.com Phone: +64 21666580 |

Renzhu Zhang [NZ] Strategic Postdoctoral Fellow, CEFGroup Email: renzhu.zhang0111@gmail.com Phone: +64 274917441 |

ABOUT

|

CEFGroup CEFGroup is one of the leading academic climate and sustainable finance teams in the world. The team embraces interdisciplinarily research and is focused on delivering policy and practitioner relevant research that has impact. As one of a few dedicated climate and sustainable finance research groupings in Australasia and Asia, CEFGroup is strategically placed to support the sustainability transition of the financial industry and broader economy. CEFGroup research is undertaken with international collaborators and has been published in leading international journals. |

MyFiduciary Ltd MyFiduciary is an independent NZ-owned investment consultant specialising in investment governance. We have broad experience across asset allocation, investment selection and funds management, our clients include charitable trusts, foundations, independent advisers, KiwiSaver Providers, and Māori and iwi organisations. |

|

Private Capital Group Private Capital Group are a dedicated team of debt managers working with New Zealand banks, businesses and investors. PCG bridges the gap between bank lending policies, funding capacity and borrowers, by deploying committed fund capital from Institutional, IWI and High Net Worth investors and lending directly to New Zealand companies. |

CEFGroup Working Paper Won 2022 NZFM CFA Asia Pacific Research Exchange Award

Climate and Energy Finance Group (CEFGroup) is pleased to announce that its working paper, In Holdings We Trust: Uncovering the ESG Fund Lemons, won the CFA ARX Asia Pacific Research Exchange Award at this year’s New Zealand Finance Meeting (NZFM).

- Presenting author: Dr Sebastian Gehricke

- Co-authors: Mr Lachie McLean, Professor Ivan Diaz-Rainey, Dr Quyen Nguyen, and Dr Renzhu Zhang

- Link to the working paper: HERE

- 2022 NZFM event page: HERE

MORE ABOUT THE PAPER

The authors surveyed asset managers of global equity funds available to Australasian investors to understand how they integrate sustainable practices within the investment decision-making process. Then, the authors compared survey responses to portfolio holdings data to evaluate whether fund managers were as environmentally responsible as they claimed to be. Some highlights:

- Responsible investing was primarily driven by performance and fund flow focused value, rather than ethical values.

- Climate change was the most important ESG sub-theme, followed by corporate behaviour. Interestingly, funds that placed higher importance on climate change, on average, had higher portfolio carbon intensity.

- Lack of understanding of portfolio carbon intensities among fund managers: Only about half of survey respondents were able to provide portfolio-level Scope 1 & 2 emissions intensity. For those that did, there was large underreporting of emissions by some funds.

- Natural capital (including biodiversity) was given low priority by managers.

- Portfolio carbon intensity was significantly higher for respondents that were members of a climate initiative, and not significantly different for those that prioritised climate change themes or engaged in a decarbonisation strategy. Results were not explained by engagement or active engagement.

CEFGroup New Publication on Climate Stress Testing

Climate and Energy Finance Group (CEFGroup)’s recent publication in International Review of Financial Analysis (IRFA), Climate Transition Risk in U.S. Loan Portfolios: Are All Banks the Same?, is now available HERE.

The paper uses a bottom-up, loan-level forward-looking approach to stress test banks’ exposure to climate transition risk (CTR) in syndicated loans. It highlights that:

- Banks vary in CTR, not only due to their exposure to the energy sectors, but also due to borrowers’ carbon emission profiles from other sectors;

- CTR is stable over time, save for a temporary (in some cases) and permanent (in others), reduction after the Paris Agreement;

- From the stress test, the median loss is 0.5% of U.S. syndicated loans, representing a proportional decrease of 4.1% in CET1 capital; and

- Banks’ vulnerabilities are also driven by the ex-ante financial risk of their borrowers more generally, highlighting that climate risk is not independent from conventional risks

Authors: Dr Quyen Nguyen, Professor Ivan Diaz-Rainey, Dr Duminda Kuruppuarachchi, Dr Matt McCarten (University of Edinburgh), and Dr Eric Tan (The University of Queensland)

CEFGroup PhD Presenting at the Inaugural Winds of Change North Asia Virtual Symposium

CEFGroup PhD candidate, Ling Liao, together with her three teammates, will be presenting their team project entitled “The Role of Carbon Market in Decarbonizing China and NZ” at the inaugural Winds of Change North Asia Virtual Symposium. The symposium is organised by the North Asia Centre of Asia-Pacific Excellence. More info below:

- Registration Link: HERE

- Date and Time: Thursday the 1st of December 2022, 1pm to 4pm New Zealand Time (or 8am to 11am Beijing Time)

- More detail about the participants and projects: See attached document

- More about Winds of Change: HERE

ABOUT WINDS OF CHANGE NORTH ASIA VIRTUAL SYMPOSIUM

The North Asia Winds of Change programme unites postgraduate students from New Zealand and China to explore climate change impacts and resilience strategies by learning from both countries. This is the inaugural North Asia version of the programme, following on from the success of the Latin America CAPE Winds of Change programme focusing on collaboration between New Zealand and Chile.

Fittingly, this first North Asia edition coincides with the 50th anniversary of diplomatic relations between New Zealand and China and illustrates the continued value of this important relationship. The participants will share the results of their collaborative projects, in the areas of water conservation, food waste, carbon markets, marine diversity, and green hydrogen.

Call for Papers – International Review of Economics and Finance Special Issue

CALL FOR PAPERS for a Special Issue on “Green Investing, Green FinTech, and Clean Technology” for the International Review of Economics and Finance

Guest Editors: Professor Ivan Diaz-Rainey (Director, CEFGroup) and Professor Ehsan Nikbakht (C.V. Starr Distinguished Professor of Finance, Hofstra University).

This special issue aims at exploring the interactions between climate change, sustainability, clean technology, FinTech and green investing through rigorous interdisciplinary research from academia and industry. Authors are invited to submit their papers in English through the journal’s submission system by 1st November, 2023.

For more information, please visit IREF – Call for Papers

Diaz-Rainey Speaking at Climate Change, Insurance, Finance and Housing Workshop

Climate and Energy Finance Group (CEFGroup) Director, Dr. Ivan Diaz-Rainey, is presenting at the Climate Change, Insurance, Finance and Housing Workshop next Wednesday. Details below:

- Presentation Title: Implications of Climate Change Risk on Residential Property Values and Financial Stability

- Date and Time: Wednesday the 23rd of November, 1:00-1:25 pm New Zealand Time [Note that the workshop runs from 9am to 6pm]

- Registration Link: HERE

- Location: Decima Glenn, Level 3, Sir Owen G Glenn Building, 12 Grafton Rd, Auckland, New Zealand

- Full Program: Climate Change, Insurance, Finance and Housing Workshop

ABOUT THIS EVENT

Join us to hear from industry experts and academics on the implications of climate change on Aotearoa’s housing markets with the introduction of new government policies on managed retreat and adaptation and discuss the future of housing as we face the prospect of financial and insurance retreat. At the conclusion of the event, there will be networking opportunities.

The workshop hosted by Resilience of the Housing Market Research Group, a joint initiative of the University of Auckland – Business School Departments of Property and Commercial Law.

Lunch, morning and afternoon tea will be provided.

Diaz-Rainey Joins RNZ Panel Discussion Including Flooding Hazards to Property

A recent NZ government report has identified dozens of communities at serious risk of flooding, with most having little protection in place to prevent flood hazards. In a recent RNZ panel, CEFGroup Director, Professor Ivan Diaz-Rainey, shared his insights on what how climate change would affect property values in flood-risk areas, and what impact flooding could have on insurance and mortgage lending risk.

The full recording is available via the following link: RNZ – The Panel with Verity Johnson and Chris Wikaira (Part 1).

Diaz-Rainey Comments on COP27 ‘Loss and Damage’ Financing Discusssion

For more than a decade, wealthy nations have rejected official discussions on what is referred to as loss and damage, the term used to describe rich nations paying out funds to help poor countries cope with the consequences of global warming for which they bear little blame.

COP27 is a turning point. For the first time, the issue of ‘loss and damage’ has finally made it onto the official agenda and become one of the dominant themes at the annual climate conference.

CEFGroup’s Director, Professor Ivan Diaz-Rainey, commented on COP27 ‘loss and damage’ financing discussion. Ivan said that the economic damages was huge in just the past decade alone, and expected developed countries to push for funding to come from, and be administered by, a number of different sources including the private sector. Ivan said time will tell whether promises by rich countries actually eventuate.

For more information, visit: RNZ – COP27: Time for Rich Countries to Pay Poorer Ones for Years of Climate Damage – Expert and Rich Countries Agree to Discuss Climate Compensation for Poor.

Climate Change: NZ Banks, Homeowners Exposed to Rising Flood Risk

CEFGroup’s Director, Professor Ivan Diaz-Rainey, had an interview with NZ Heralds this Tuesday. He shared his concerns re how climate risks affects the New Zealand housing market, and how this would pose risk to the country’s economy.

Diaz-Rainey and his team are exploring the threat themselves, in the Marsden Fund-supported project that involves developing new models to test property impacts against.

For more information, visit: NZ Herald – Climate Change: NZ Banks, Homeowners Exposed to Rising Flood Risk and the STRAND Marsden Fund Project’s home page.

CEFGroup’s Presentation to Stanford SFI Seminar

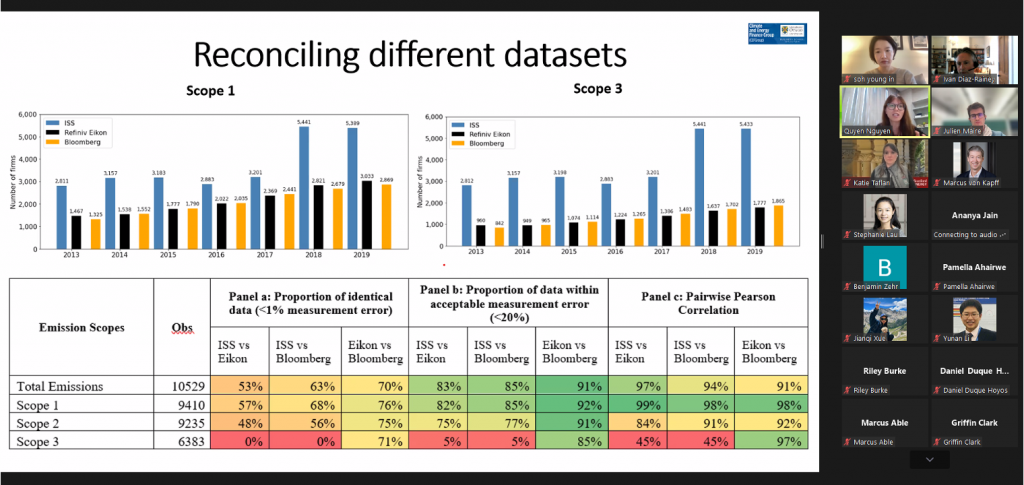

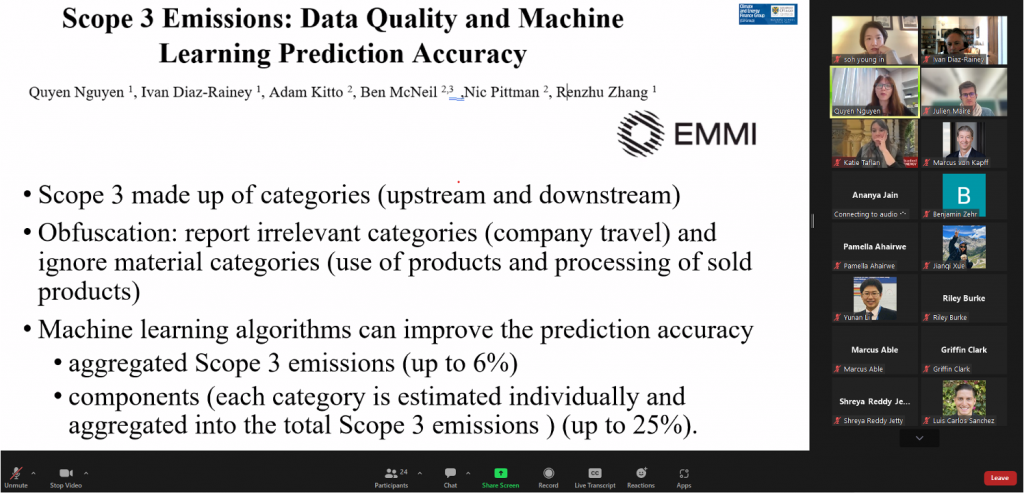

CEFGroup’s Professor Ivan Diaz-Rainey and Dr Quyen Nguyen presented to Stanford University‘s Sustainable Finance and Investment Seminar today. They introduced how transition risk is measured and highlighted associated challenges with particular focus on corporate carbon footprints,

Diaz-Rainey and Nguyen showed that the application of machine learning algorithms to fill the carbon data gaps lead to improved prediction accuracy especially in Scope 1 and Scope 2 emissions. For Scope 3 emissions, firms’ voluntary disclosures have measurement divergence and incomplete composition problems, and prediction accuracy is primarily limited by low observations in particular categories.

Finally, they used actual and predicted corporate carbon footprint data to examine US banks’ exposure to climate transition risk using a bottom-up, loan-level methodology incorporating climate stress test based on the Merton probability of default model and transition pathways from the Intergovernmental Panel on Climate Change.

The presentation drew from several research projects of Diaz-Rainey and Nguyen, including their work with EMMI.

For more information, visit HERE.

For Stanford Precourt Institute for Energy’s upcoming events, visit HERE.