CEFGroup Deputy Director’s Sharesies Shared Lunch Podcast

CEFGroup Deputy Director, Dr Sebastian Gehricke, spoke at the Sharesies Shared Lunch Podcast today. Details below:

- Date and Time: Thursday 13th October 2022, 12:15pm-1:15pm New Zealand Daylight Time

- Recording available HERE

- Description: Demand is ramping up for investments to meet environmental, social and governance standards. But is the impact an investor is hoping to achieve the same as a fund will deliver? ESG can take many guises so what really makes an impact? Sharesies discussed this dilemma and much much more with Dr Sebastian Gehricke from Otago University’s Climate & Energy Finance Group.

Shared Lunch is a conversation with experts, CEOs, and you. Each week, Sharesies alternates between an interview with a company leader and an industry deep dive. Episodes are hosted by BusinessDesk journalists including Frances Cook and Dan Brunskill.

CEFGroup Director Speaking at the 2022 World Investor Week in AIFC

CEFGroup Director, Professor Ivan Diaz-Rainey, has been invited to join a panel discussion on “Investing in Sustainable Finance Products” at the 2022 World Investor Week (WIW) in AIFC. Details below:

- Date and Time: Wednesday 5th October 2022, 6:00pm-6:50pm New Zealand Daylight Time (or Wednesday 25th October 2022, 11:00am-11:50am Alma-Ata Time)

- Event Page: Visit HERE. Full program available HERE

- Link for Registration: HERE

WIW will be held in the AIFC from 3rd to 7th October 2022 in hybrid format. This year the central theme of the WIW-2022 is “Sustaining Resilience Investing”. The events will be conducted under three tracks: (1) Understand risks; (2) Embrace education; and (3) Invest smart.

The main objectives of the event are: (1) promotion of investor education and protection; (2) raising awareness about consumer protection and investment risks; (3) facilitating financial education and financial literacy through informing about investing smart; (4) discussion of innovations in financial markets.

Thematically, the world investor week at AIFC is devoted to raising awareness on investor resilience, investor education and protection, crypto assets, sustainable finance, Islamic finance, frauds and scams prevention. Several thematic forums, such as ESG Investments Forum, New Financial Instruments Forum, Digital Assets Investments Forum, Islamic Finance Forum, Financial Literacy Forum and others will be held on margins of the WIW.

CEFGroup Working Paper Accepted for Presentation at the Frontiers of Climate and Nature in Macroeconomics and Finance Conference

CEFGroup’s working paper, entitled Performance and Climate Risk in Microfinance Institutions, has been accepted for presentation at the Frontiers of Climate and Nature in Macroeconomics and Finance Conference. Details below:

-

- Presenting Author: Mr Iftekhar Ahmed

- Co-authors: Professor Ivan Diaz-Rainey and Associate Professor Helen Roberts

- Date and Time: Tuesday 25th October 2022, 9:30pm-10:00pm New Zealand Daylight Time (or Tuesday 25th October 2022, 10:30am-11:00am Central European Summer Time)

The conference is hosted by the Banque de France, Network for Greening the Financial System (NGFS), sustainable macro and INSPIRE. Full program attached below. For more information, please visit the event page.

Frontiers of Climate and Nature in Macroeconomics and Finance Conference Program

CEFGroup’s Fruitful Visit in Europe

CEFGroup’s Renzhu Zhang presented two CEFGroup working papers to the University of Seville and the University of Burgos this September. Details below:

Market Responses to Electrifying Transport: Evidence from Global Car Manufacturers

- Date and Time: Monday 12th September 2022, 8:00pm-9:00pm New Zealand Time

- Host: Accounting and Financial Economics Department, University of Seville

In Holdings We Trust: Uncovering the ESG Fund Lemons

- Date and Time: Thursday 15th September 2022, 2:00am-3:00am New Zealand Time

- Host: Faculty of Economics and Business Studies, University of Burgos

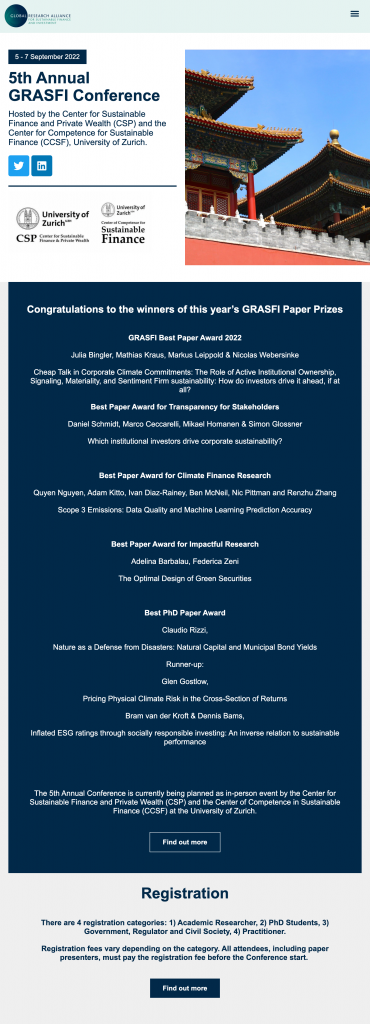

Note that Renzhu also presented the “In Holdings We Trust” paper at the 5th GRASFI Annual Conference in Zurich, hosted by the Centre for Sustainable Finance and Private Wealth (CSP) and the Centre for Competence for Sustainable Finance (CCSF), University of Zurich. For more information, visit the conference website or follow live tweets from the conference on Twitter (@susfinalliance).

STRAND Marsden Project Upcoming Seminar Presentations

The Green and Sustainable Finance (GSF) transversal research programme of the Institut Louis Bachelier and the interdisciplinary Energy4Climate Center (E4C, Institut Polytechnique de Paris) is hosting a joint seminar 10.00am-11.30am CEST on Monday the 12th of September, at the premises of Institut Louis Bachelier.

Dr Quyen Nguyen, CEFGroup’s STRAND Marsden Postdoctoral Fellow, will present their latest research on the topic of “Asset-Level Modelling of Climate Change-Related Flooding Risk”. The authors highlight the importance of uncertainty estimates when they relate to high impact public-interest decision-making.

For more information, visit HERE. To register, click HERE.

Note that the working paper has also been presented to the ITC Centre for Disaster Resilience at University of Twente this Friday (9th September), 11.00-11.45am CEST. Recording is now publicly available HERE.

CEFGroup Working Paper Won GRASFI Best Research Paper in Climate Finance Award

CEFGroup is delighted to announce that its working paper, Scope 3 Emissions: Data Quality and Machine Learning Prediction Accuracy, won this year’s GRASFI Best Paper Award for Climate Finance Research. This is work from CEFGroup’s fruitful partnership with Emmi that developed related work on an earlier paper on Scope 1 and 2 emissions (click HERE).

Presenting and lead author: Dr Quyen Nguyen (CEFGroup)

Co-authors: Professor Ivan Diaz-Rainey (CEFGroup), Mr Adam Kitto (Emmi), Dr Ben McNeil (Emmi and Climate Change Research Centre at UNSW), Mr Nic Pittman (Emmi and University of Tasmania), and Dr Renzhu Zhang (CEFGroup)

The prize was awarded to the team by the Centre for Climate Finance & Investment at Imperial College Business School.

Read the winning paper via the following link: Scope 3 Emissions: Data Quality and Machine Learning Prediction Accuracy

New CEFGroup IAEE Working Paper on NZ ETS

CEFGroup’s new IAEE working paper highlights that NZU prices may have been distorted by overallocation and unlimited international offset. Abstract below:

ABSTRACT

The New Zealand Emission Trading Scheme (NZ ETS) is the second oldest national ETS in the world and is unique in that it includes forestry as a carbon sink (a source of unit supply). Further, NZ ETS has been subject to many policy changes including a switch from allowing unlimited importation of units to becoming completely autarkic. In this context, we analyse the pricing dynamics for New Zealand Units (NZUs) driven by the interaction between allowances supply and demand between 2010 and 2019 and for two sets of subperiods divided by the official and actual de-link dates. Our empirical models find that international offset negatively affected NZU returns before the actual de-link date, domestic supply after the official de-link date, and banked units between the official and actual de-link dates, and that green (mainly forestry) offsets, surprisingly, positively affected NZU returns before the actual de-link date. Our results also highlight that from a demand perspective, sectoral effects had significant relationships with NZU returns with different dynamics. Namely, manufacturing and construction activities shifted to negatively affect NZU returns after the official de-link date, implying that fixed allocative baselines have resulted in over-allocation over time. Stationary energy sector activities shifted from negatively to positively affecting NZU returns after the official de-link date probably due to their exploitation of unlimited international offset during the linking period.

A copy of the working paper could be found via the following link: The Role of Fundamentals and Policy in New Zealand’s Carbon Prices

Authors: Ms Ling Liao, Professor Ivan Diaz-Rainey, Dr Sebastian Gehricke, Dr Duminda Kuruppuarachchi

Business Can No Longer Ignore Extreme Heat Events – It’s Becoming A Danger to the Bottom Line

Do you know UK and EU businesses lose almost 975 million New Zealand dollars in annual sales for every additional degree of excessive temperature?

Do you know that extreme heat not only affects businesses’ profitability, but may also damage your investment portfolio?

The Conversation article, written by CEFGroup‘s David Lont and Paul Griffin, and Victoria University of Wellington‘s Martien Lubberink, unveils how heat waves hit organisations’ bottom line and investors’ confidence. Click HERE for more.

A copy of the working paper could be found via SSRN: Click HERE.

CEFGroup Director to Speak at CoreLogic Climate Change Panel

Join CoreLogic New Zealand‘s Climate Change Panel on Thursday 7th of July, where several climate experts, including CEFGroup Director Ivan Diaz-Rainey, will be discussing the increasing impact of climate change on New Zealand property, and the implications for the financial stability of Kiwis, businesses and our broader economy. Details below:

Addressing climate change, financial stability and property in New Zealand

Thursday, 7th July 2022

12.30pm – 1.30pm

(including 15 mins live Q&A)

Panelists include:

-

Mark Baker Jones – Director, Te Whakahaere

-

Ivan Diaz-Rainey – Director, Climate and Energy Finance Group (CEFGroup), University of Otago

-

Belinda Storey – Managing Director, Climate Sigma

-

Olaf Adam – Senior Manager of Sustainability, Westpac New Zealand

-

Tom Larsen – Senior Director of Insurance Solutions, CoreLogic US

-

Bernard Hickey (moderator), independent commentator

Two CEFGroup Papers Accepted for Presentation at the 5th Annual GRASFI Conference

Two CEFGroup papers have been accepted for presentation at the 5th Annual GRASFI Conference. Details are as follows:

Presentation Title: In Holdings We Trust: Uncovering the ESG Fund Lemons

-

Date and Time: Tuesday 6th September 12:45am-1:15am New Zealand Time (or Monday 5th September 2:45pm-3:15pm Central European Summer Time)

-

Presenter: Renzhu Zhang (Strategic Postdoctoral Fellow, CEFGroup, University of Otago)

-

Authors: Mr. Lachie McLean, Associate Professor Ivan Diaz-Rainey, and Dr. Sebastian Gehricke

Presentation Title: Scope 3 Emissions: Data Quality and Machine Learning Prediction Accuracy

-

Date and Time: Tuesday 6th September 8:50pm-9:20pm New Zealand Time (or Tuesday 6th September 10:50am-11:20am Central European Summer Time)

-

Presenter: Quyen Nguyen (STRAND Marsden Postdoctoral Fellow, CEFGroup, University of Otago)

-

Co-Authors: Associate Professor Ivan Diaz-Rainey, Adam Kitto, Dr. Ben McNeil, Nic Pittman and Dr. Renzhu Zhang

Conference agenda is available HERE. To register, click HERE. For more information, visit the conference website.