Private debt markets are a relatively untapped investment option in Aotearoa New Zealand despite significant growth overseas, a new report reveals. Private debt is a way for companies to borrow, but rather than obtaining the funds from banks, they receive the money from institutional investors.

The report, drawing on a survey of institutional investors, is a collaboration between the Climate and Energy Finance Group (CEFGroup) at the University of Otago, Griffith University, MyFiduciary, and Private Capital Group.

The survey focuses on the potential and challenges of the private debt market in New Zealand, seeking to understand stakeholders’ views on private debt and how this can help the country transition toward sustainability.

The private debt market is still largely underutilised in New Zealand, with many investors yet to make their first commitment to this asset class.

The survey highlights several challenges for investors, such as a lack of experience, liquidity risks, and a relatively small market size. This may be attributed to limited knowledge of its benefits and misconceptions about its complexity and risk.

Dr Renzhu Zhang, the lead author, of the University of Otago, says overseas investors view private debt as a means to obtain higher returns, while this is not a major focus for investors in New Zealand.

“It’s almost like they don’t see the potential for really doing well out of it,” Dr Zhang says.

Private Capital Group Founder and CEO Paul Carman says domestic investors are not fully aware of the differences between public and private markets due to the latter’s novelty in New Zealand.

Mr Carman says the regulatory pressures on bank capital have driven the growth and development of private debt markets offshore, and are now doing so in New Zealand.

MyFiduciary Principal Greg Peacock is positive about the development of the market in New Zealand, saying private debt has grown to have a significant share of the lending market overseas and has provided robust returns to investors.

“The same pattern is just beginning in New Zealand,” Mr Peacock says.

These sentiments are supported by the survey’s findings, which indicate both private and non-private debt investors are optimistic about the future of the asset class.

The survey results indicate that the positive outlook among private debt investors suggests the asset class has been rewarding for those who have invested in it.

The survey also shows strong support for the development of a private debt market in the country, with investors viewing it as a critical tool in achieving their environmental, social and governance (ESG) and impact goals.

Professor Ivan Diaz-Rainey, of Griffith University, says a big advantage that private debt investors have, is that they can ask companies tough questions directly about their sustainability and then measure their ongoing performance.

“Our survey results indicate that investors see it as a great way to have an impact on sustainability. Because it’s a much more direct investment between the investor and the investee company.”

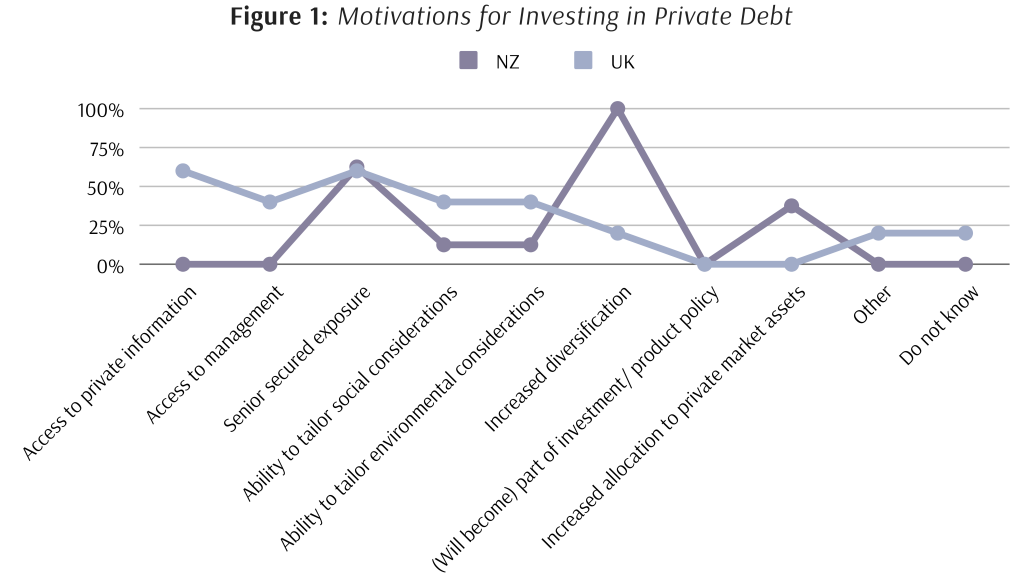

The survey finds notable differences between investors in New Zealand and the UK regarding their motivations for investing in private debt (see Figure 1, above).

UK investors place greater emphasis on access to private information and management, as well as the ability to customise their investments with social and environmental considerations.

On the other hand, New Zealand investors are attracted to private debt as a means of diversifying their investments and spreading risks.

Further, the two groups have different preferences when it comes to what they hope to gain from investing in private debt.

New Zealand investors tend to prioritise safety and are more conservative, preferring to invest in asset-rich companies, while investors in the UK are more willing to lend to riskier sectors.

Professor Diaz-Rainey suggests that to achieve the country’s economic goals, New Zealand investors will need to broaden their perspective and be open to investing in private debt in businesses that are not just asset-rich.

He emphasises the potential for the private debt market to be a significant driver of growth and sustainability for New Zealand.

“It’s a huge opportunity for the country. Along with private equity and traditional bank lending, it could play an import role in funding the next generation of Kiwi companies.”

A copy of the industry report can be found here: A Private Debt Market for a Sustainable Aotearoa NZ

For further information, please contact:

|

Paul Carman [NZ] Founder and CEO, Private Capital Group Email: paul@privatecapitalgroup.co.nz Phone: +64 273400929 |

Ivan Diaz-Rainey [AUS] Professor of Finance, Griffith University Email: i.diaz-rainey@griffith.edu.au Phone: +61 426910630 |

|

Greg Peacock [NZ] Principal, MyFiduciary Email: greg@myfiduciary.com Phone: +64 21666580 |

Renzhu Zhang [NZ] Strategic Postdoctoral Fellow, CEFGroup Email: renzhu.zhang0111@gmail.com Phone: +64 274917441 |

ABOUT

|

CEFGroup CEFGroup is one of the leading academic climate and sustainable finance teams in the world. The team embraces interdisciplinarily research and is focused on delivering policy and practitioner relevant research that has impact. As one of a few dedicated climate and sustainable finance research groupings in Australasia and Asia, CEFGroup is strategically placed to support the sustainability transition of the financial industry and broader economy. CEFGroup research is undertaken with international collaborators and has been published in leading international journals. |

MyFiduciary Ltd MyFiduciary is an independent NZ-owned investment consultant specialising in investment governance. We have broad experience across asset allocation, investment selection and funds management, our clients include charitable trusts, foundations, independent advisers, KiwiSaver Providers, and Māori and iwi organisations. |

|

Private Capital Group Private Capital Group are a dedicated team of debt managers working with New Zealand banks, businesses and investors. PCG bridges the gap between bank lending policies, funding capacity and borrowers, by deploying committed fund capital from Institutional, IWI and High Net Worth investors and lending directly to New Zealand companies. |