2nd CEFGroup Climate Finance Symposium

2nd CEFGroup Climate Finance Symposium

DATES: 30th November – 1st December 2021

HYBRID EVENT:

Online for non-NZ residents, and

At Otago Business School, Dunedin, for NZ residents

|

|

|

|

|

There has been a growing appetite for green finance in the entire financial system. Organisations around the world are shifting quickly to incorporate sustainable practices across all of their investments, services and strategies, driving benefits for society as a whole.

The Climate and Energy Finance Group (CEFGroup) welcomes submissions of papers for its second academic climate finance symposium. We welcome papers in all areas of climate finance, sustainable finance, energy finance, carbon finance, ESG investing/reporting etc.

We intend to divide the symposium into two broad tracks. Day one will have a focus on climate finance and related innovative methodologies (GIS modelling, simulation, stress testing, machine learning etc.) and policy implications. Day two will focus more on conventional empirical and theoretical papers in sustainable finance.

Download the Symposium Schedules:

- CEFGroup Symposium Schedule – Day One

- CEFGroup Symposium Schedule – Day Two

- CEFGroup Symposium Schedule – Easily Printable Version

Most of our symposium recordings are now publicly available via the CEFGroup YouTube channel:

KEYNOTE SPEAKERS

| Picture | Name | Position | Country | Topic and Recording |

|---|---|---|---|---|

|

Diana V. Barrowclough | Senior Economist, United Nations Conference on Trade and Development (UNCTAD) | Switzerland | Banks, Bonds and the Petrochemicals/Plastics Industry: Greening the Path from Copenhagen, Covid and Beyond |

|

Andreas Hoepner | Professor of Operational Risk, Banking & Finance, University College Dublin; Head of Data Subgroup & Member of the Platform on Sustainable Finance, European Commission |

Ireland | Climate Change and the EU Regulatory Response: Absolutely Sustainable ‘Paris-Aligned’ Investing |

|

Jesse M. Keenan | Associate Professor of Real Estate, Tulane University | United States | Barriers and Accelerants of Climate Finance Policy and Practice in the U.S. |

|

Vassili Kitsios | Research Scientist, CSIRO Oceans and Atmosphere | Australia |

Influence of Climate Variability on Financial Markets and the Health Sector |

|

Martina Linnenluecke | Professor of Environmental Finance & Director of the Centre for Corporate Sustainability and Environmental Finance, Macquarie University | Australia | Beyond Climate Finance: Integrating Broader Environmental Change Frameworks into Financing and Investment Decisions |

|

Ben Marshall | MSA Charitable Trust Professor in Finance, Massey University | New Zealand | Climate Disasters and Insider Trading |

|

Irene Monasterolo | Professor of Climate Finance, EDHEC Business School; Co-founder, CLIMAFIN |

France | Climate Stress Test: Lessons We Learned and Steps Ahead |

|

Sanel Tomlinson | Acting COO and Director of Integrated Reporting and Climate-special Projects, External Reporting Board (XRB) | New Zealand | Update from XRB Re Progress on Setting the First Climate Standards |

PANEL DISCUSSANTS

TOPIC: Challenges in Modelling Climate Finance Risks

Keynote speakers Jesse M. Keenan [United States], Vassili Kitsios [Australia], and

| Picture | Name, Position Held & Country |

|---|---|

|

Olaf Adam, Senior Manager of Sustainability, Westpac New Zealand. [New Zealand] |

|

Michael Lebbon, Founder and CEO, EMMI. [Australia] |

The event is FREE for online participants.

For those attending in person that are non-Otago staff, a $50 per day catering fee applies. This fee does not apply to PhD students. We can help arrange accommodation at one of the university’s residential colleges.

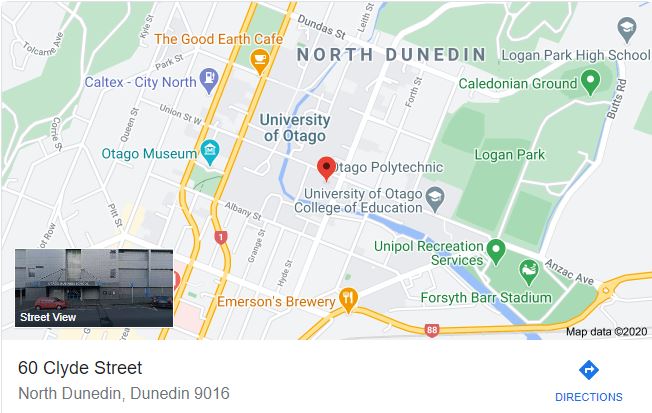

SYMPOSIUM VENUE

Lecture Room 1.17

Otago Business School

60 Clyde Street, Dunedin 9016

New Zealand

CALL FOR PAPERS

IMPORTANT DATES

Submission Deadline: Friday, 15th October, 2021

Notification of Acceptance (Latest): Friday, 29th October, 2021

Registration & Payment Deadline: TBC

PAPER SUBMISSION

Submit Full Paper to CEFGroup@otago.ac.nz by 15th October, 2021. Making clear:

-

- Whether you are a student

-

Identify yourself as either

-

Non-NZ resident – please let us know what time zone you are in

-

NZ residents – please let us know if you intend to attend in person

-

Contact Email: CEFGroup@otago.ac.nz

AREAS OF SPECIAL INTEREST

| Areas of Special Interest | Areas of Special Interest |

|---|---|

|

Application of machine learning to energy and climate finance |

Financing renewable energy and electrification of transport |

|

Biodiversity and blue (ocean) finance |

Green, transition, catastrophe and SDG bonds |

|

Blended finance to meet SDG goals |

Greening public finances (e.g. 2021 green budget in France) |

|

Carbon pricing and carbon markets |

Green taxonomies |

|

Climate risk in the banking and insurance sectors |

Greenwashing analyses and critiques |

|

Climate-related financial risk measurement, including stress testing methods and scenario analyses |

Impact investing |

|

Climate-related engagement (shareholder resolutions and litigation) |

Innovative forward-looking methods in sustainable finance |

|

Climate change and property values |

Net-zero portfolio management |

|

Electricity markets |

Spatial finance (GIS, remote sensing etc.) application to sustainable finance |

|

ESG investing |

Stranded assets risk |

|

Estimates of climate financing need at the firm, country and regional levels |

Sustainable finance education |

|

Financial innovations to enable green finance |

Surveys related to sustainable finance |

|

Financing energy efficiency investments (e.g. passive houses and deep retrofits) |

TCFD reporting and climate disclosures |

Download the Call for Papers Poster

ORGANISING COMMITTEE: Associate Prof. Ivan Diaz-Rainey, Dr. Duminda Kuruppuarachchi, Dr. Quyen Nguyen, Dr. Renzhu Zhang