CEFGroup Director Invited to Speak at Tsinghua PBCSF Green Finance Seminars

Ivan Diaz-Rainey, Director of the Climate and Energy Finance Group (CEFGroup) has been invited to speak at the Tsinghua PBCSF‘s green finance seminars. Details below:

Presentation Title: Climate Transition Risk: Measurement Challenges and Application in Bank Stress Testing

Speaker: Associate Professor Ivan Diaz-Rainey

Date and Time: Friday 27th May 7:00pm-8:30pm New Zealand Standard Time (or Friday 27th May 3:00pm-4:30pm Beijing Time)

Venue: Follow THIS LINK. Then click the blue button “立即学习“

For more information, please visit Tsinghua Center for Green Finance Research’s event page.

CEFGroup Two Live Webinars Achieved Great Success

CEFGroup hosted two webinars this week, featuring Paul Carman, Founder and CEO of the Private Capital Group (PCG), Simone Robbers, RBNZ Assistant Governor, and Susan Livengood, RBNZ‘s newly appointed Director of Sustainability and Financial Inclusion. Our events attracted around 150 people from more than 20 organisations.

Presentation recordings from our past webinars/ seminars are now publicly available via the CEFGroup YouTube Channel. It’s time to catch up on the sessions you missed out or revisit the ones you enjoyed!

PICTURE: CEFGroup Director Ivan Diaz-Rainey (right) Showed PCG Founder and CEO Paul Carman (left) around the Campus

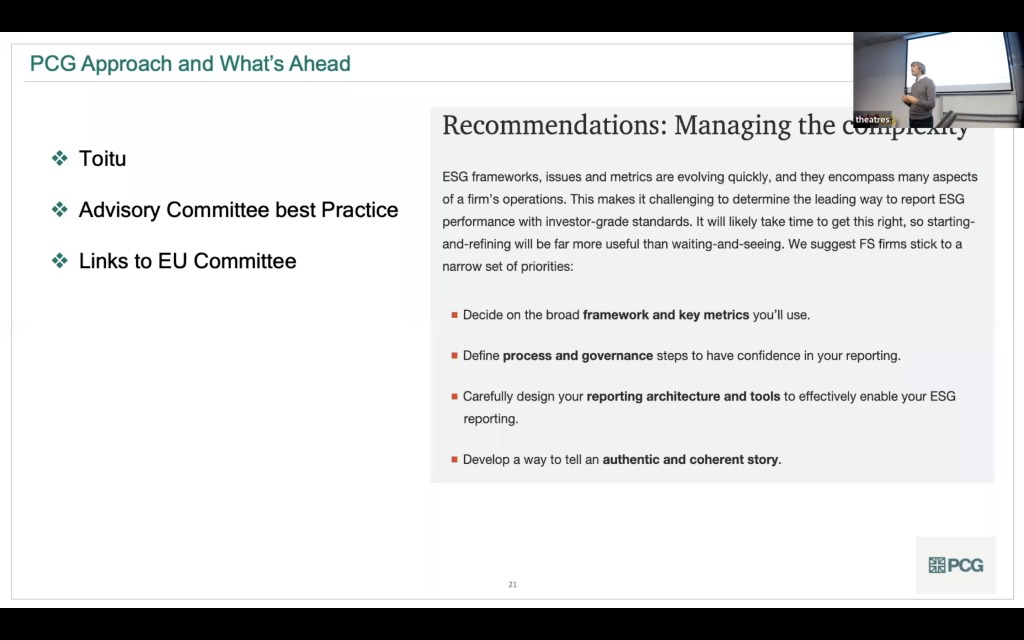

SCREENSHOT: PCG Guest Lecture/Live Webinar

SCREENSHOT: RBNZ Guest Lecture/Live Webinar

Upcoming IAEE Webinar – Scope 3 Emissions: Data Quality and Machine Learning Prediction Accuracy

Ivan Diaz-Rainey, Director of the Climate and Energy Finance Group (CEFGroup) and Quyen Nguyen, CEFGroup STRAND Marsden Postdoctoral Fellow, have been invited to speak at the International Association for Energy Economics (IAEE)‘s webinar series. Details of the webinar are as follows:

Presentation Title: Scope 3 Emissions: Data Quality and Machine Learning Prediction Accuracy

Speakers: Associate Professor Ivan Diaz-Rainey and Dr Quyen Nguyen

Date and Time: Tuesday 28th June 8:00am-9:00am New Zealand Standard Time (or Monday 27th June 4:00pm-5:00pm Eastern Time)

The webinar is free-of-charge but registration is required and seats are limited. Sign up to ensure a spot!

For more information, please visit IAEE’s event page.

Climate Change: Rising Sea Level Data Likely to Have Immediate Impact on Coastal House Prices – Expert

Nick Goodall, Head of Research at CoreLogic and Member of the Advisory Group at CEFGroup’s STRAND Marsden Fund Project, was interviewed by Rebecca Wright on Newshub Live at 8pm last night (Monday the 2nd of May). Nick talked about the impact of sea-level rise flooding hazards on house prices – one preliminary finding from the STRAND Project.

The news article is available HERE.

For more information on the STRAND Marsden Fund Project, visit HERE.

CEFGroup Working Paper Featured in International Media

CEFGroup Deputy Director, Sebastian Gehricke, was recently interviewed by the Institutional Investor, discussing CEFGroup’s recent working paper entitled “In Holdings We Trust: Uncovering the ESG Fund Lemons” which explores New Zealand investable fund managers’ stated ESG beliefs, motivations and strategy and evaluates their portfolio ESG performance.

The news article is available HERE.

For more information on the working paper, visit New Research: In Holdings We Trust: Uncovering the ESG Fund Lemons.

ACC to Sponsor AOIC Sustainable Investing Event in 2022

CEFGroup is pleased to announce that ACC is joining the Precinct Properties to become the sponsors for the Assembly of Investment Chairs (AOIC) in 2022, where not-for-profit, Iwi and community trust organisations can receive and share knowledge on investing to tackle ESG challenges such as climate change, human rights and social issues.

“The AOIC presents a significant opportunity to discuss challenges and opportunities in ESG investing, in the context of creating real-world impacts and aligning investor and manager purpose,” says Dr Sebastian Gehricke, Deputy Director of CEFGroup, University of Otago. ACC Investment’s sponsorship “will allow the leadership team to continue, grow and improve this impactful event.”

The AOIC has been an annual event since 2019, convened by CEFGroup, one of the world’s largest climate and sustainable finance teams, and the NZ Super Fund.

For more information, visit the AOIC 2021 Event Page and the recent ACC Press Release.

Join Us at the GBSN Capability Development for Sustainable Finance & ESG Investments Roundtable

How can capability and capacity be developed in the global south? Join us to discuss this critical issue at the Global Business School Network (GBSN) Capability Development for Sustainable Finance & ESG Investments Roundtable. Details are as follows:

- Date and Time: Thursday the 5th of May, 6:00am-7:30am Eastern Daylight Time (i.e., Thursday the 5th of May, 10:00pm-11:30pm New Zealand Time)

- Speakers: Edith Aldewereld [Sustainable Finance Advisor, ACATIS Fair Value Investment AG], Giles Cuthbert [Managing Director, Chartered Bank Institute], Clemente del Valle [Director, Center for Sustainable Finance, Universidad de Los Andes], Lyn Javier [Assistant Governor of the Policy and Specialized Supervision Sub-Sector, at Bangko Sentral ng Pilipinas], and Rui Zhu [Professor of Marketing, Director of Social Innovation and Business for Good Center, and Director of Common Prosperity and Social Innovation Center, Cheung Kong Graduate School of Business]

- Moderators: Felip Calderon, Ivan Diaz-Rainey, Dan LeClair, Aditya Singh, and Viviane Torinelli

- More Details: See GBSN’s event page

- Click HERE to register

STRAND Project Publication: Price Recovery after the Flood

Available Open Access: https://onlinelibrary.wiley.com/doi/full/10.1111/1467-8489.12471

Abstract: We take advantage of a combination of a severe weather event from 3 to 4 June 2015 and a local policy, to investigate the housing market response to climate change-related flooding hazard. The study focuses on a residential area in a low-lying coastal suburb of Dunedin, New Zealand, where the groundwater level is shallow and close to sea level. An unusually heavy rain event in June 2015 resulted in flooding of a significant portion of land in especially low-lying areas. The city council responded by reviewing processes for storm-water management and by imposing minimum-floor-level [MFL] requirements on new construction in the low-lying areas previously identified as at risk of flooding. Applying a ‘diff-in-diff-in-diff’ strategy in hedonic regression analyses, we find that houses in the MFL zone sell for a discount of about 5 per cent prior to the flood. This discount briefly tripled in the area that flooded, but disappeared within 15 months, indicating either very short memory among homebuyers or no long-run change in perception of hazard.

CEFGroup leads Otago researcher submission on ETS consultation “Managing exotic afforestation incentives by changing the forestry settings in the NZ Emissions Trading Scheme”

Dr Sebastian Gehricke gathered a group of experts from the University of Otago to submit to the new ETS setting for the permanent forest category. It Is great to see the scheme evolve in a way to try and avoid unintended consequences, but there are many more improvements that are more nuanced. Two main suggestions in the submission were:

- Create differentiation in carbon credits or have a native/biodiversity token to be sold alongside credits, for carbon which is sequestered native/sustainable forests.

- Adjust the rules to incentivise/account for the benefits of continuous cover canopy (native or high value exotic), which is a proven forestry management system used by many European countries for better environmental and commercial outcomes.

To find out more on these experts’ thoughts, read the attached submission.

Otago University Researchers Response – Managing exotic afforestation incentives

CEFGroup Deputy Director Shared Recent Working Paper on Sharesies Podcast

CEFGroup Deputy Director, Sebastian Gehricke, was recently interviewed by the Sharesies podcast discussing CEFGroup’s new working paper which explores Australasian fund managers’ stated ESG beliefs, motivations and strategy and evaluates their portfolio ESG performance.

The interview is 7 minutes in total (also available on apple music and other platforms): Click HERE

Key findings are as follows:

- ESG investing is driven mainly by expected value rather than values

- Climate Change is the most important ESG theme for fund managers

- Fund managers struggle to provide even the simplest climate risk metrics and when they do, these are underreported

- Climate initiative signatory funds have significantly higher #carbon intensities than non-signatories

For more details and a copy of the study visit:

New Research: In Holdings We Trust: Uncovering the ESG Fund Lemons