Marsden Fund Award: Climate-Change Risks to Property Values

CEFGroup Director Associate Professor Ivan Diaz-Rainey and colleagues Associate Professor Antoni Moore (School of Surveying), Dr Paul Thorsnes (Department of Economics), Dr Simon Cox (GNS Science) and Dr Greg Bodeker (Bodeker Scientific) have secured a Marsden Fund grant ($869,000) from the Royal Society of New Zealand. The Reserve Bank of New Zealand is a partner in the project.

Project Title: Should I stay or should I go? Climate-change risks to property values across space and time, and the related implications for financial stability

Read more on Otago Bulletin and the ODT

CEFGroup Director on Mindful Money Sustainable Finance Forum Discussion

CEFGroup, Director Associate Professor Ivan Diaz-Rainey, was on a panel hosted by Mindful Money with Anne-Maree O’Connor (Head of Responsible Investment. New Zealand Super Fund) and Justine Sefton (Head of Sustainable Finance, KPMG) discussion Aotearoa Circle Sustainable Finance Forum Roadmap for Action Final Report 2020. See recoding of the panel here.

Aotearoa Circle Roadmap for Action Final Report 2020 – Input from CEFGroup Director

The Aotearoa Circle Sustainable Finance Forum Roadmap for Action Final Report 2020 was published at an launch event 3 November 2020, Auckland. CEFGroup Director, Associate Professor Ivan Diaz-Rainey is on the Technical Working Group of the Aotearoa Circle Sustainable Finance Forum and contributed to the report.

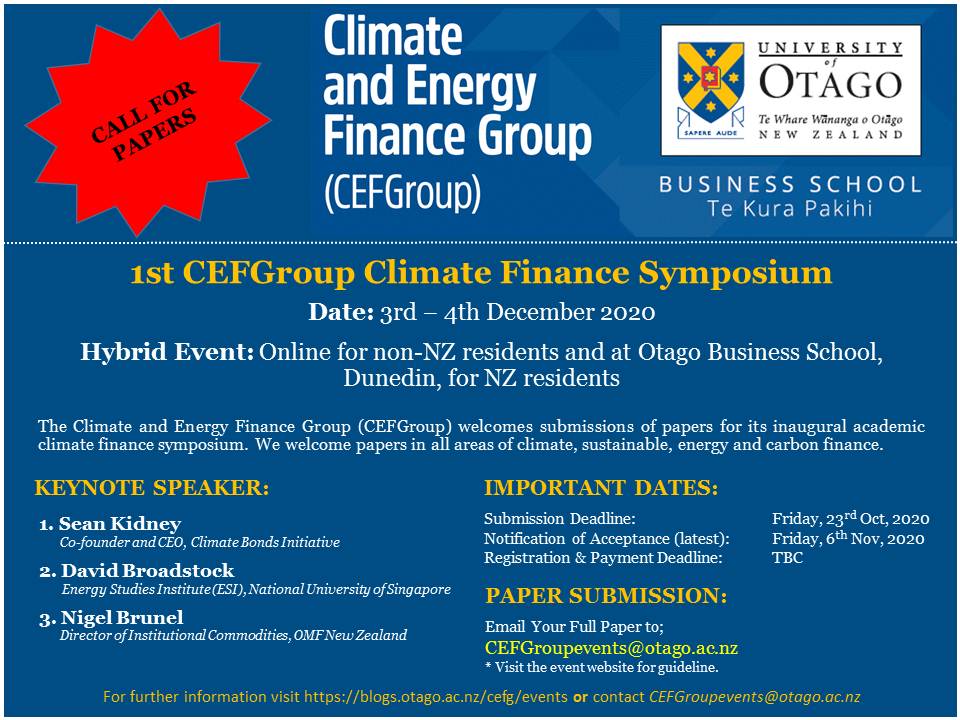

Climate Finance Symposium

CALL FOR PAPERS

1st CEFGroup Climate Finance Symposium

Hybrid Event on 3rd – 4th December 2020

The Climate and Energy Finance Group (CEFGroup) welcomes submissions of papers for its inaugural academic climate finance symposium. We welcome papers in all areas of climate, sustainable, energy and carbon finance.

Submission Deadline: Friday, 23rd October, 2020

For details visit the webpage.

Joint OERC and CEFGroup Seminar

Joint OERC & CEFGroup Seminar: COVID-19, disruption and new energy futures seminar which will be held next Wednesday 21st October at 12 noon.

Our speaker is Karen Silk, GM Experience Hub, Westpac New Zealand, and and co-chair of the Sustainable Finance Forum. Karen will provide her thoughts on opportunities and challenges that have arisen due to COVID-19 and its aftermath and the role that Sustainable Finance can play to help mitigate future environmental and social crises.

Join via Zoom, Passcode: 582894

Seminar: Green Investment: Do Climate Disasters Matter?

Professor Ben Marshall from Massey University will present his research on Friday, 21st August 2020, at 14.00 PM via Zoom.

Joint Dept. of Accountancy and Finance, and CEFGroup Seminar

Details below:

Abstract

We consider the degree to which climate disasters influence investor behavior. Using data on events such as hurricanes and floods, we show that disasters cause investors to pay more attention to socially responsible investing and to invest more in mutual funds with an environmental focus. This effect is more pronounced for disasters that attract the most attention which supports a salience explanation. The funds receiving the increased inflows do not have higher risk-adjusted returns prior to climate disasters so there is no evidence to support a return chasing explanation. Moreover, investors do not make excess returns from their climate disaster induced investment decisions.

To join via Zoom click here. Password: 842964

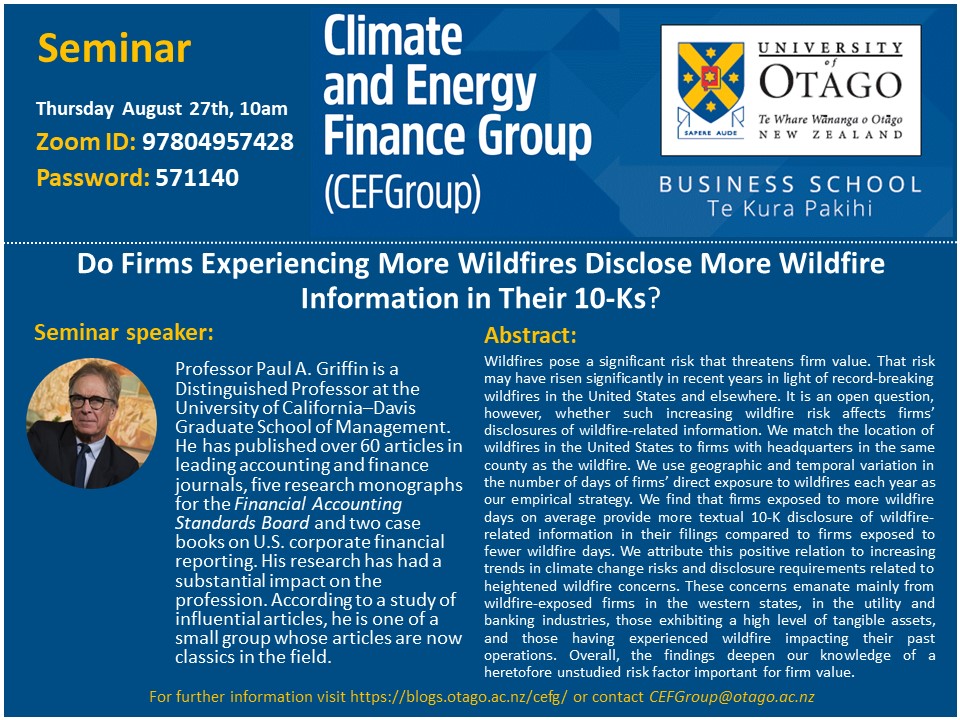

CEFGroup Webinar: Do Firms Experiencing More Wildfires Disclose More Wildfire Information in Their 10-Ks?

The Climate & Energy Finance Group (CEFGroup) will be hosting its next webinar on the Thursday 27th August 2020 at 10.00 AM (NZST).

The details of the webinar are as follows:

To join via Zoom click here. Password: 571140

Call for Papers: Special Issue of Climate Policy Journal

Call for Papers

Special Issue intended for publication in Climate Policy on Climate Finance in Asia and Australasia

The financial risks and opportunities associated with climate change are particularly acute in Asia and Australasia. The region is highly vulnerable to climate change related natural disasters. Further, in meeting the demand of growing populations and economic growth, governments in the region have tended to lag other parts of the world (with notable exceptions, such as the Peoples Republic of China). It is in this context that we welcome submission to this Special Issue intended for publication in Climate Policy.

For details visit the webpage or download full Call for Papers.

Call for Papers: Workshop on Climate Finance in Asia and Australasia

Tied to the 3rd GRASFI Conference 2020

Wednesday 9th (EST 8pm) / Thursday 10th (China Standard Time 8am) of September

The aim of the workshop is to encourage community building among researchers focused on climate finance in Asia and Australasia. We take a broad definition of climate finance-related topics (see list of topics below) and we welcome submission from a range of methodological approaches (empirical analyses, theoretical, macroeconomic/monetary-environment models, case studies, policy analyses etc.). Papers should have clear relevance to policy or investment practice and utilise Asian and Australasian data or context.

Paper Submission: Submit full paper or a long abstract by Monday 24th of August 2020 to CEFGroup@otago.ac.nz putting ‘Asia GRASFI Workshop – Paper Submission’ in the subject line.

For more information see the workshop webpage.

New Publication in FT 50 Journal

CEFGroup member Muhammad Nadeem has recently published in an FT 50 journal, Journal of Business Ethics. Details of the paper is below.

Nadeem, M. (2020). Corporate governance and supplemental environmental projects: A restorative justice approach. J Bus Ethics. Advance online publication. doi: 10.1007/s10551-020-04561-x

Congratulations Nadeem!

Summary:

Firms have traditionally responded to environmental violations by increasing information disclosure and/or communication to manage stakeholder perceptions. As such, these approaches may be symbolic in nature, with no genuine intention to improve the environment. We draw from restorative justice grounded in stakeholder theory and explore a relatively new approach in the form of supplemental environmental projects (SEPs) aimed at restoring the environment, and empirically examine the role of corporate governance (board structure) in firms’ decisions to undertake reparative actions. Using environmental violations and SEPs data from the US Environmental Protection Agency between 2002 and 2015, we find that firms with smaller boards are more likely to undertake SEPs. We also find that firms with higher board independence and CEO duality undertake SEPs more frequently; however, board gender diversity and the existence of a sustainability committee appear to have no impacts. These results are robust to propensity score matching and an alternative data source. We extend the scope of stakeholder theory by emphasizing a new approach—restorative justice—by which corporations can repair damaged relationships and also improve the environment. We also contribute to corporate governance and environmentalism literature by identifying governance structures that promote environmental restorative justice. Thus, our study will inform different stakeholders, including regulators, shareholders, and boards of directors, and will open new avenues for business ethics scholarship.